View pictures in App save up to 80% data.

Yelp (NYSE:YELP - Get Free Report) had its price objective increased by equities researchers at Morgan Stanley from $34.00 to $35.00 in a report released on Monday,Benzinga reports. The firm presently has an "underweight" rating on the local business review company's stock. Morgan Stanley's price objective indicates a potential downside of 9.42% from the company's current price.

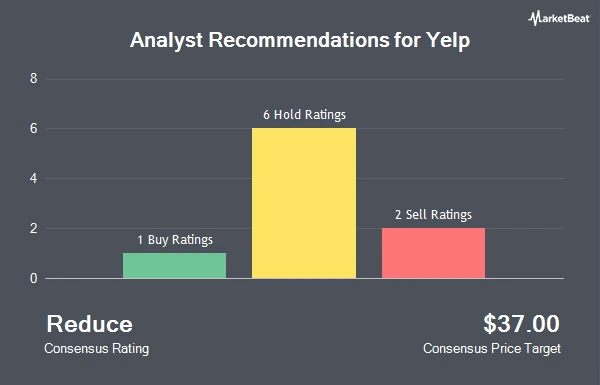

Several other research analysts also recently issued reports on the company. StockNews.com raised Yelp from a "buy" rating to a "strong-buy" rating in a report on Monday, November 11th. Robert W. Baird reduced their price objective on Yelp from $39.00 to $37.00 and set a "neutral" rating on the stock in a report on Friday, November 8th. The Goldman Sachs Group downgraded Yelp from a "buy" rating to a "neutral" rating and reduced their price objective for the stock from $46.00 to $38.00 in a report on Monday, October 14th. Bank of America assumed coverage on Yelp in a report on Monday, September 16th. They set an "underperform" rating and a $30.00 price objective on the stock. Finally, Evercore ISI raised Yelp to a "hold" rating in a research note on Monday, November 11th. Two equities research analysts have rated the stock with a sell rating, six have issued a hold rating, one has given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $37.17.

Yelp Shares Increase by 0.5%

NYSE YELP traded up $0.21 during trading hours on Monday, reaching $38.64. 263,510 shares of the company's stock were exchanged, compared to its average volume of 474,813. The stock has a market cap of $2.54 billion, a PE ratio of 23.14, a price-to-earnings-growth ratio of 0.71 and a beta of 1.34. Yelp has a one year low of $32.56 and a one year high of $45.91. The firm has a fifty day moving average of $38.08 and a 200-day moving average of $35.96.

Insider Transactions: Buying and Selling Activities

In related news, insider Craig Saldanha sold 1,000 shares of the firm's stock in a transaction on Friday, November 29th. The stock was sold at an average price of $38.05, for a total transaction of $38,050.00. Following the sale, the insider now owns 184,558 shares of the company's stock, valued at approximately $7,022,431.90. This trade represents a 0.54 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, CTO Sam Eaton sold 10,744 shares of the stock in a transaction dated Thursday, November 21st. The stock was sold at an average price of $35.12, for a total value of $377,329.28. Following the transaction, the chief technology officer now owns 122,480 shares of the company's stock, valued at approximately $4,301,497.60. This trade represents a 8.06 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 45,865 shares of company stock valued at $1,734,268. 7.40% of the stock is owned by company insiders.

Hedge Funds Provide Insights on Yelp

Multiple hedge funds have recently adjusted their positions in Yelp's stock. In the third quarter, Exchange Traded Concepts LLC increased its stake by 54.5%, now holding 1,148 shares valued at $40,000 after adding 405 shares in the last quarter. GAMMA Investing LLC saw a significant increase of 115.9% in its Yelp holdings, bringing its total to 976 shares worth $34,000 following the acquisition of 524 additional shares during the same period. Signaturefd LLC also raised its investment in Yelp by 98.5% in the third quarter, now owning 1,175 shares valued at $41,000 after buying 583 extra shares. In the second quarter, Meeder Asset Management Inc. established a new position in Yelp valued at approximately $25,000. Additionally, Quarry LP expanded its Yelp holdings by 153.4% in the second quarter, now possessing 1,323 shares worth $49,000 after acquiring 801 shares. Overall, institutional investors hold 90.11% of the company's stock.

Yelp is a popular platform that allows users to discover and review local businesses. Founded in 2004, it has grown into a go-to resource for finding restaurants, shops, and services based on user-generated feedback. Yelp provides a space for customers to share their experiences, rate businesses, and write detailed reviews, helping others make informed decisions. The platform also offers features like reservation bookings, photo sharing, and business information, making it a comprehensive tool for both consumers and business owners.

( Get Free Report )Yelp Inc provides a platform that links consumers to local businesses both in the United States and around the globe. This platform encompasses a wide range of categories, such as dining, retail, beauty and wellness, healthcare, alongside additional sectors like home services, local activities, automotive, professional services, pet care, events, real estate, and financial solutions.

View pictures in App save up to 80% data.

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Before you make any decisions about Yelp, there's something important you should know.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yelp wasn't on the list.

Although Yelp presently holds a "Reduce" rating from analysts, leading analysts suggest that these five stocks are more favorable investment options.

Click the link below to receive MarketBeat's comprehensive guide on investing in 5G, highlighting the most promising 5G stocks to consider.

Download Your Complimentary ReportEnjoyed this article? Pass it along to a coworker!