View pictures in App save up to 80% data.

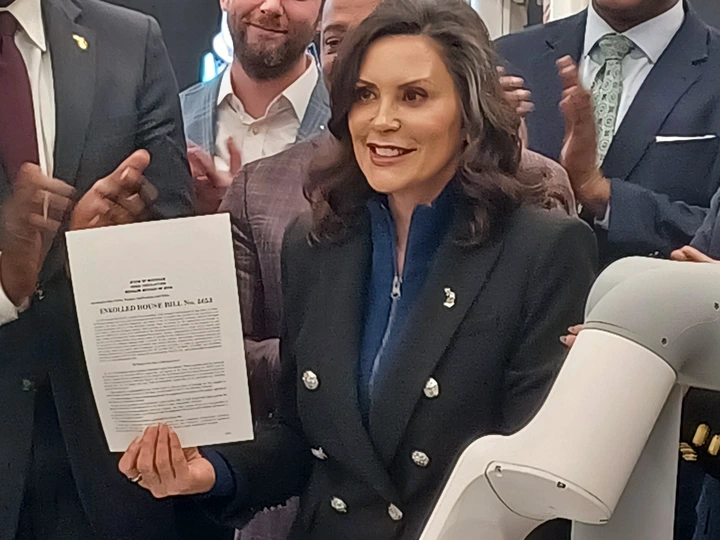

Detroit — Gov. Gretchen Whitmer on Monday signed into a law a series of bills hailed as "game-changing" that will create grants to stir up entrepreneurship in Michigan and offer tax credits for research and development in the state.

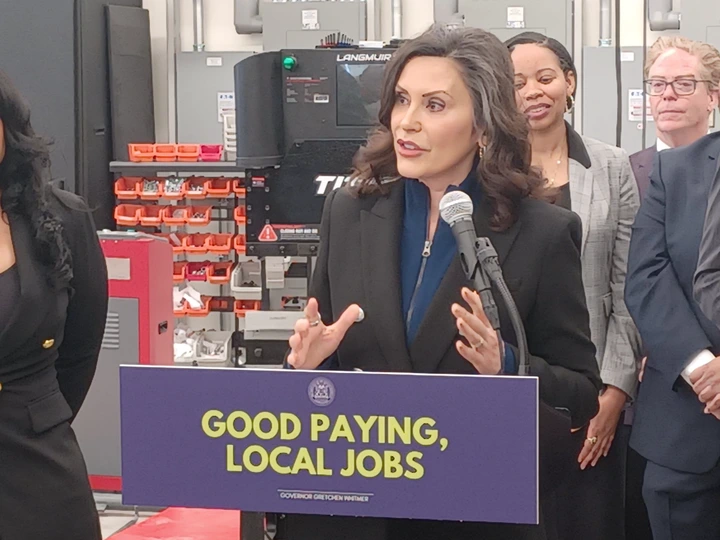

The incentives help Michigan catch up to other states in economic development tools, according to state leaders. The bipartisan legislation will make access to funding easier for startups by offering grants to venture capital funds, encourage R&D in Michigan and seek to attract high-paying technology jobs, including in the automotive industry.

"These two legislative packages represent a remarkable and inspiring milestone, marking the first substantial and tangible effort by the state of Michigan to genuinely support and invest in individuals with innovative ideas, making Michigan the ideal environment for anyone to conceive and nurture their concepts," stated Lt. Gov. Garlin Gilchrist at a press conference held at the Newlab technology co-working space next to Michigan Central Station in Corktown. "No other state will surpass Michigan in transforming ideas into reality."

View pictures in App save up to 80% data.

R&D incentives

House Bills 5100 and 5101 propose amendments to the Income Tax Act, allowing companies to receive credits for research and development costs against their corporate income tax. Additionally, these bills aim to offer credits against withholding taxes for flow-through entities that are not liable for corporate income tax. As a result, the financial burden of conducting research and development in Michigan will be reduced.

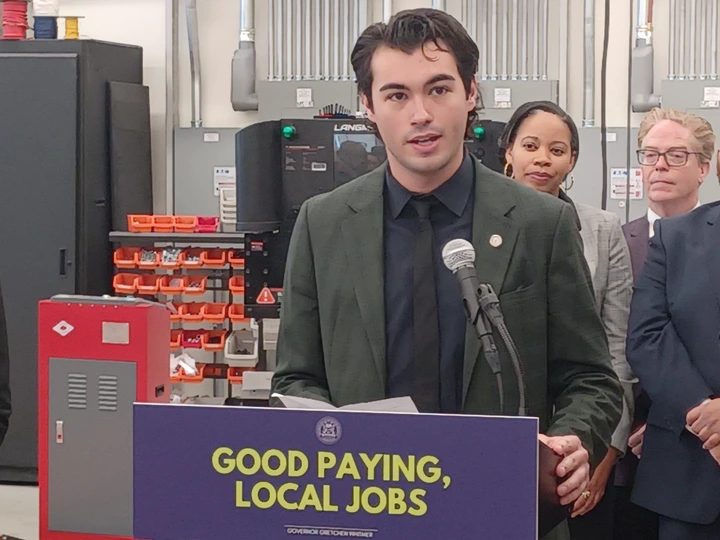

"Michigan stood out as the sole state in the Midwest and among fewer than twelve in the nation that did not offer a research and development tax credit," stated State Rep. Jasper Martus, D-Flushing, who is sponsoring the bill. "The nearest states to us without such a credit are West Virginia and South Dakota, which puts us at a disadvantage. We aimed to change that situation, and now we will position ourselves as a leader on the national stage."

View pictures in App save up to 80% data.

They allocate $100 million for credits starting January 1, 2024, allowing companies to benefit from expenses incurred in the previous year. Twenty-five percent of the total funds are set aside for businesses with 250 employees or less.

Businesses are eligible for a credit of equal to 3% of their qualifying R&D expenses in the year up to the law's base amount. A business with more than 250 employees, which incurs expenses in excess of the base amount, would be eligible for a credit of 10% of the expenses above the base amount, up to $2 million. The smaller businesses would be eligible for a credit of 15% of its expenses above the base amount, up to $250,000.

A business also could claim an additional credit for 5% of its R&D expenses over the base amount if those expenses are incurred in collaboration with a Michigan research university. The additional credit would be capped at $200,000.

View pictures in App save up to 80% data.

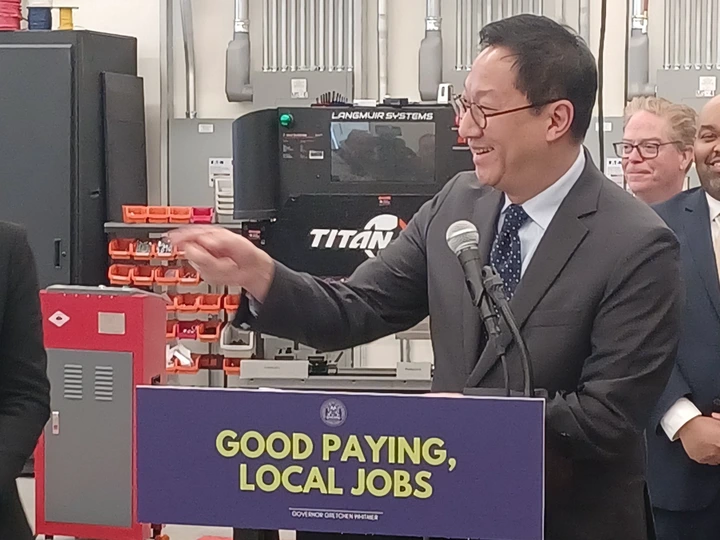

"What's taking place in Michigan, with the collaboration between government, universities, and organizations like Newlab, is truly groundbreaking and sets the stage for significant innovations that will boost the economy for many years ahead," stated Santa Ono, president of the University of Michigan. "This marks a pivotal moment in the state's history."

In order to obtain the credit, an authorized business must file a preliminary claim with the Michigan Treasury by March 15 of the year following the end of the calendar year.

"There's a widespread initiative within the state to continue evolving our economy, and these tools play a crucial role in that," stated Glenn Stevens, executive director of MichAuto, which is part of the Detroit Regional Chamber focused on the automotive sector. "Rather than diversifying away from our core industries, we should be amplifying our efforts in those areas while simultaneously drawing in new industries. This approach facilitates that growth."

Encouraging investment in venture capital

House Bills 5651, 5652, and 5653 create the Michigan Innovation Fund. These bills permit the early use of investment returns from the Michigan Early State Venture Investment program's funds, allowing access before 2030. The funds will be allocated as grants to venture capital firms and nonprofit organizations to foster investments in early-stage companies via the Jobs for Michigan Investment Fund.

View pictures in App save up to 80% data.

"Many Michiganders possess innovative ideas, but securing the necessary funding to launch those ideas can be challenging," Whitmer stated before endorsing the legislation. "When you're embarking on a new venture that has the potential to generate well-paying jobs and boost our economy, it's crucial that you can access the capital required to kick things off. With our new innovation fund, Michigan is here to support you."

She remarked, "By investing in an entrepreneur and helping their business thrive, it's the residents of Michigan who ultimately reap the rewards."

View pictures in App save up to 80% data.

Crystal Brown, the CEO of CircNova Inc., a biotech startup established in 2023 with a team of eight in Michigan, expressed that the recent funding would greatly benefit entrepreneurs like herself: "Having access to the innovation fund would have transformed my journey, and it continues to hold immense value."

House Bills 5651 and 5652 allocate $60 million for the fiscal year 2024-25 to transfer funds from the Michigan Early Stage Venture Investment program to the 21st Century Jobs Trust Fund, which has been established by House Bill 5653 under the Michigan Strategic Fund Act. Additionally, a projected $65 million is expected to be redirected from the Michigan Early Stage Venture Investment program to the state general fund as a result of this initiative, as noted in a summary provided by the House Fiscal Agency.

The innovation fund, which will be accessible until the end of the fiscal year 2053-54, will be managed by the governing body of the Michigan Economic Development Corporation. Grants must be distributed to all qualifying applicants.

"We’re declaring the grit, creativity, and enduring prowess of our entrepreneurs and innovators deserve to be supported and showcased," Ben Marchionna, MEDC's chief innovation ecosystem officer at the MEDC, said in a statement. "Equitable, accessible funding and an R&D-friendly tax environment is how we’ll transform today’s big ideas into tomorrow’s growth industries."

Venture capitalists are required to allocate funds from the grant within a five-year timeframe. A minimum of 5% of the grant funds must be directed towards businesses located in economically disadvantaged areas. Additionally, recipients of the grant must agree to reinvest at least 85% of the funds received from the grant into their ventures. Up to 15% of the grant can be utilized for administrative costs and technical support, which includes coaching, mentoring, and programs designed to assist business founders.

Recipients of venture capital are required to remit 10% of the returns from an investment to the state treasurer if the investment, funded by the grant, yields a return of at least $8 million for the general fund within a 15-year period following the investment.

View pictures in App save up to 80% data.

"We're opening up a pathway," stated State Rep. Alabas Farhat, D-Dearborn, "for our local talent in Michigan to remain here, to work in Michigan, and to invest in Michigan." House Bill 5653 also removes the stipulation within the state's Venture Capital Investment Program that mandates investments solely in companies focusing on competitive-edge technologies, and it modifies the program to stipulate that venture capital funds receiving investments must be based in Michigan.

View pictures in App save up to 80% data.

"Today's developments serve as a remarkable asset for our goal of expanding startups in Michigan," stated Carolina Pluszczynski, COO of Michigan Central Innovation District LLC, home to 130 startups by Newlab. "They guarantee that entrepreneurs with visionary concepts have access to the necessary resources to realize their ambitions and contribute to the growth of Michigan's economy."